|

Colombia is located in Central and South America, with a total population of about 49.6 million. In recent years, the country's economy has begun to recover. The 2018 GDP growth rate reached 2.658%, which is about twice as much as in 2017, and for the economy of 2019-2020. The situation, the international organization OECD, IMF, etc., said that the Colombian economy will begin to improve, and the GDP growth rate in 2019-2020 is estimated to reach around 3%. However, despite the positive attitude towards Colombia's economic growth, considering the economic collapse of neighboring country Venezuela in recent years or the drag on the development of Colombia and the long-term debt problem, the strength of growth is estimated to be in a state of slow recovery. The international credit rating agency Moody's gave Colombia's Baa2 a rating and the economic outlook was stable.

In terms of climate, more than 80% of the land in Colombia is located below 1,000 meters above sea level. The average temperature in these areas is about 24 degrees Celsius, and the average temperature in high altitude areas is about 6-12 degrees. On the other hand, Colombia is a country with a rainy season longer than the dry season. The Caribbean Coast has a dry season of about January to February, the rest of the month is the rainy season, and the southern part is the rainy season except June-July. There is almost no dry season. In terms of the amount of sunshine, the average daily rate per square meter can reach 4.5kWh.

Overview of renewable energy development in Colombia

In the middle of 2018, the Colombian general election ended. The newly appointed government is more active in promoting renewable energy. It is set in the 2018-2022 National Development Plan (Bases Del Plan Nacional De Desarrollo 2018-2022) in 2018-2022. 1.5 GW of renewable energy cumulative installations will be realized in four years, and the projects that achieve the target installed capacity will be mainly concentrated on photovoltaics and wind power.

At this stage, the main way to promote the development of renewable energy is bidding. In February this year, the country’s first renewable energy bid was launched. However, some developers who participated in the bidding did not follow the bidding specifications. Therefore, the bidding government decided not to assign any projects to fail. end. In June this year, the news of renewable energy bidding was released again. The results of the bidding were released in October. At that time, the winning bidders must complete the project's production before 2022.

On the other hand, the government has also actively introduced relevant policies to support the development of renewable energy in the near future. The first is to establish a renewable energy quota system. In September this year, the Ministry of Energy and Mines (Ministerio De Minas Y Energia) issued the number No. 40715 to request the power company. At least 10% of the power generation must be generated from renewable energy. It also requires the power company to sign a PPA for at least 10 years to purchase green power. The policy will take effect in 2022.

Second, the government has also drafted a power grid expansion plan for the period from 2019 to 2023, including the allocation of existing power stations, the arrangement of new power stations and feeders, etc., in response to the demand for future renewable energy growth.

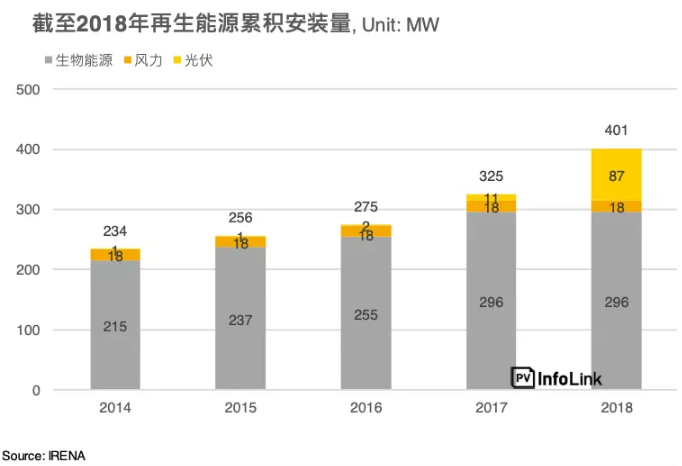

As of the end of 2018, the cumulative installed capacity of renewable energy (non-hydropower) reached 401 MW. Compared with 2017, the total installed capacity grew by about 23%. Most of the installed projects came from Bioenergy, and PV was received in recent years. The stimulus of the policy, the demand also has a growing trend, while the wind is in a stagnant state.

Overview of Colombian PV Policy and Development

In 2014, the Colombian government issued Act No. 1715 to provide renewable energy equipment exempt from VAT and import tariffs, and to open up the development of the local renewable energy industry. In the photovoltaic industry, unlike the past, the net-Metering model was adopted to encourage residents to install power stations to meet the demand for electricity and to implement their own use. In recent years, the benefits of photovoltaics have been significant, and the government has begun to actively invest in large-scale projects. The development of the power station and the completion of the country's first large-scale photovoltaic power station in 2017, the installed capacity of the project is about 9.8MW.

Then, with the establishment of a new renewable energy target in the 2018-2022 National Development Plan and the new government's attitude towards renewable energy development after taking office, the No. 0030 Act was approved in August 2018 to simplify distribution. The project's grid-connected procedures and provide power station user guidance mechanisms to help them understand the power plant operations and subsidies.

What is more noteworthy is that the government has also planned the bidding for large-scale power station projects simultaneously, and in October 2019 completed the country's first large-scale renewable energy (wind + photovoltaic) bidding, a total of about 1.3GW of tenders. The PV project is about 350MW (all marked by Trina Solar) and the wind project is around 950MW. The average bid price is about COP 95.65/kWh (about US$ 0.028/kWh). The total number of projects is eight. It consists of five wind projects and three photovoltaic projects, all of which have been signed for a 15-year PPA and will be connected to the grid by 2022.

Finally, considering that the tender volume is very close to the 1.5GW renewable energy cumulative installation target set by the national development plan, the possibility of launching a new round of tenders in the short term is not expected, and will continue until 2022. To meet the installed needs of these projects.

Colombia Import and Export Analysis

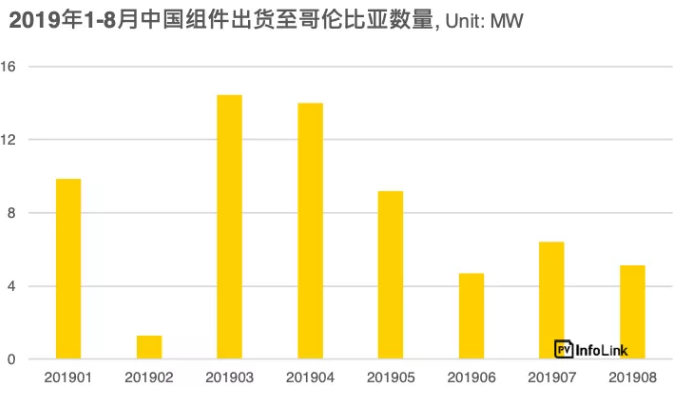

From January to August 2019, the number of Chinese components shipped to Colombia was about 65MW. The total amount is small. It is estimated that it is mainly for IPP and distributed project demand. Considering the recent completion of large-scale renewable energy project bidding in China, the component pull Demand for goods may begin to show up next year, and overall shipment performance in 2020 is expected to be stronger than this year.

in conclusion

Colombia is expected to achieve 1.5 GW of renewable energy cumulative installations by 2022. Last year, the newly-elected government also reported a positive attitude toward renewable energy development. In addition to reforming policies for distributed projects, it also introduced the country’s first large-scale regeneration. The energy bidding has also completed the bidding operation in the near future, and a total of about 1.3GW of bids has been issued.

From the perspective of overall shipments, it is estimated that IPP and distributed projects are the mainstay. Since the entire bidding process is completed in October, plus the process of project planning, financing, and signing PPA, the fastest projects are expected. The demand for pulling goods will begin to appear next year, and the closer to the target period, the estimated strength will gradually increase.

According to the current plan, the PV market in Colombia is worth looking forward to, but considering that the total number of standard documents issued has approached the original target installed capacity, it is unlikely that a new round of bidding will be introduced in the short term. Will be to meet the needs of these bidding projects. On the other hand, Colombia has recently been affected by the economic collapse of neighboring country Venezuela, dragging down the strength of economic development, and whether it will affect the country's future renewable energy development remains to be seen.

|